Pacific Prime Things To Know Before You Get This

Pacific Prime Things To Know Before You Get This

Blog Article

Indicators on Pacific Prime You Should Know

Table of ContentsA Biased View of Pacific PrimeSee This Report about Pacific PrimeThe 6-Minute Rule for Pacific PrimeThe smart Trick of Pacific Prime That Nobody is DiscussingAn Unbiased View of Pacific Prime

Your representative is an insurance policy professional with the knowledge to direct you through the insurance policy procedure and aid you find the most effective insurance policy protection for you and the individuals and things you care concerning most. This short article is for informative and recommendation functions just. If the policy protection descriptions in this short article problem with the language in the policy, the language in the plan applies.

Insurance policy holder's fatalities can likewise be contingencies, especially when they are thought about to be a wrongful death, along with property damage and/or destruction. Due to the unpredictability of said losses, they are identified as contingencies. The insured individual or life pays a costs in order to get the benefits guaranteed by the insurer.

Your home insurance coverage can assist you cover the damages to your home and manage the price of restoring or repair services. Often, you can additionally have insurance coverage for products or belongings in your home, which you can then purchase replacements for with the money the insurer gives you. In case of an unfortunate or wrongful death of a sole earner, a family's financial loss can potentially be covered by certain insurance policy strategies.

The Definitive Guide to Pacific Prime

There are different insurance policy intends that include cost savings and/or investment plans along with regular coverage. These can assist with building cost savings and wealth for future generations using routine or repeating investments. Insurance coverage can help your family keep their standard of living on the occasion that you are not there in the future.

The most fundamental type for this type of insurance policy, life insurance policy, is term insurance coverage. Life insurance policy in basic assists your household end up being safe monetarily with a payment amount that is given up the event of your, or the plan holder's, death throughout a details plan duration. Child Plans This kind of insurance coverage is essentially a savings instrument that assists with generating funds when children get to particular ages for going after college.

Home Insurance coverage This kind of insurance policy covers home problems in the occurrences of accidents, natural calamities, and mishaps, along with other similar events. global health insurance. If you are looking to seek payment for accidents that have taken place and you are battling to identify the appropriate path for you, get to out to us at Duffy & Duffy Law Practice

The smart Trick of Pacific Prime That Nobody is Talking About

At our law practice, we understand that you are undergoing a lot, and we recognize that if you are coming to us that you have been via a great deal. https://giphy.com/channel/pacificpr1me. Due to the fact that of that, we provide you a free consultation to go over your problems and see how we can best help you

Due to the fact that of the COVID pandemic, court systems have been shut, which negatively affects car crash instances in an incredible way. We have a great deal of skilled Long Island car mishap attorneys that are enthusiastic regarding battling for you! Please call us if you have any questions or concerns. maternity insurance for expats. Again, we are right here to help you! If you have an injury case, we want to make certain that you get the compensation you are worthy of! That is what we are here for! We happily serve the individuals of Suffolk Area and Nassau County.

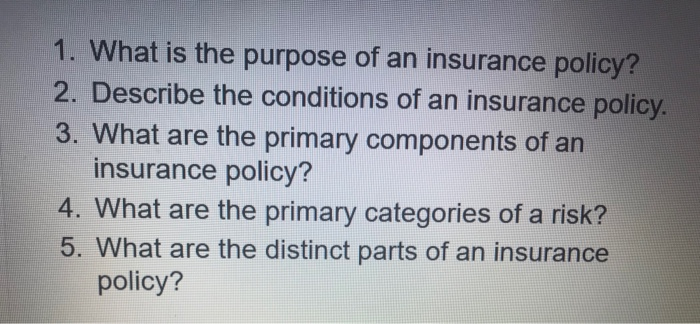

An insurance coverage is a legal contract between the insurer (the insurance provider) and the individual(s), service, or entity being insured (the insured). Reviewing your policy helps you verify that the plan satisfies your needs and that you comprehend your and the insurance provider's obligations if a loss happens. Lots of insureds purchase a plan without understanding what is covered, the exclusions that take away coverage, and the problems that must be fulfilled in order for coverage to apply when a loss occurs.

It recognizes that is the guaranteed, what threats or home are covered, the plan restrictions, and the policy duration (i.e. time the plan is in pressure). As an example, the Declarations Page of a car plan will certainly consist of the summary of the automobile covered (e.g. make/model, VIN number), the name of the individual covered, the costs amount, and the deductible (the quantity you will need to spend for an insurance claim before an insurance firm pays its portion of a protected case). The Affirmations Page of a life insurance policy will consist of the name of the person guaranteed and the face amount of the life insurance plan (e.g.

This is a summary of the major promises of the insurance business and mentions what is covered. In the Insuring Arrangement, the insurance firm concurs to do specific points such as paying losses for protected dangers, providing certain solutions, or consenting to protect the insured in here are the findings a responsibility claim. There are two basic types of an insuring agreement: Namedperils insurance coverage, under which only those dangers especially detailed in the plan are covered.

The Buzz on Pacific Prime

Allrisk protection, under which all losses are covered except those losses especially omitted. If the loss is not omitted, after that it is covered. Life insurance policy plans are usually all-risk policies. Exemptions take insurance coverage away from the Insuring Agreement. The 3 major kinds of Exclusions are: Excluded hazards or root causes of lossExcluded lossesExcluded propertyTypical examples of left out perils under a property owners plan are.

Report this page